China’s corn price to remain stable at the start of 2018

Publish time:12/29/2017 12:00:00 AM Source: CCM

Information collection and data processing: CCM For more information, please contact us

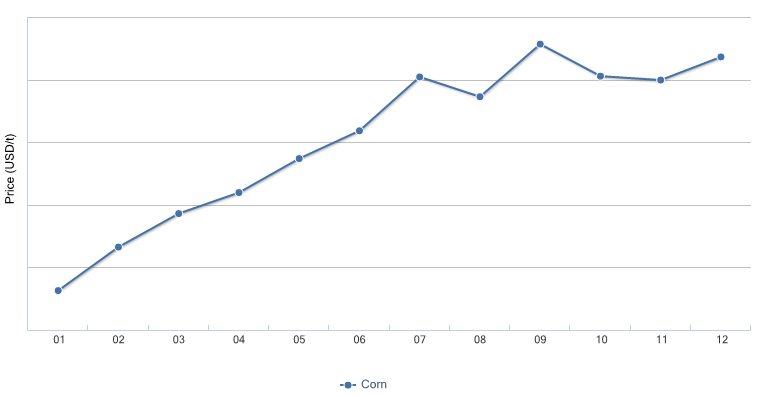

China’s corn price witnessed a stable trend in the harvesting season of 2017, due to less output of corn, caused by extreme weather occurrences which damaged parts of the crop. However, the price is likely to remain overall stable in the beginning of 2018, despite the price hike in December, facing high supply and moderate demand.

Corn Price in China in 2017

Source: CCM

Market intelligence firm CCM is of the opinion that the price hikes, which are happening since the start of December in China, are just a psychological game between corn sellers and buyers, without real substance to support the rise.

China’s corn stockpile and planting reforms, which indicate a reduced corn output and planting area in China in the past year as well as in the coming years, have resulted in a price gap between Chinese and world supplies, with a difference higher than many investors have forecasted.

The information of this article comes from CCM, China’s leading market intelligence provider for the fields of agriculture, chemicals, and food & feed.

For a detailed analysis of China’s corn market, please have a look at China’s monthly newsletter about corn products in China and the recently published industrial market research reports.

For any inquiries, please contact our team directly at econtact@cnchemicals.com or call on 86-20-37616606.

People who read this article also read what the article

- Petrochemical Industry: Policy - led Shifts, Product Trends & Global Scenarios 2025/02/17

- Refrigerant industry into the boom cycle Fluorine chemical enterprises in the half-yearly report substantial increase 2024/10/22

- Analysis of the Titanium Dioxide market in 2024 2024/10/21

- In Nov. 2024, TiO2 market price drops under tech innovation and anti - dumping 2024/11/18

- China Phosphorus Chemicals Market: Tight Supply-Demand Balance Keeps Phosphoric Acid Price High 2024/11/15

- Processing and Trade Sugar Volume Shrinks YoY, COFCO Sugar's Revenue and Profit Decline in the First Three Quarters 2024/10/31

- Analysis on Thiazophos Market Structure and Direction 2024/12/10