Varying sugar output of the world’s largest producing countries 2016-17

Publish time:3/16/2017 12:00:00 AM Source: CCM

Information collection and data processing: CCM For more information, please contact us

After three years of declining sugar production worldwide, the output has finally witnessed a growth in the sugar extracting season of 2016/17* again. However, the biggest producers showed different developments in their sugar output. Market intelligence firm CCM has analysed the four biggest sugar producing countries, namely Brazil, India, China, and Thailand, in terms of output and conditions.

Source: Pixabay

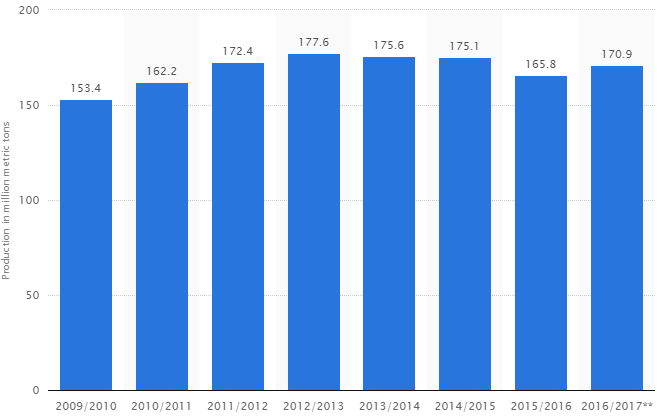

The worldwide output of sugar has increased again in the extracting season of 2016/17. According to Statista, the sugar production in 2016/17 reached 170.9 million metric tonnes. This amount represents an increase of 5.1 million metric tonnes compared to the extracting season of 2015/16. However, the output is still lower than in the three seasons before, whose witnessed global sugar outputs from 175.1 to 177.6 million metric tonnes.

Sugar production worldwide from 2009/2010 to 2016/17 (in million metric tonnes)

Source: Statista

Brazil

According to CCM, Brazil is once more the largest sugar extractor in the season 2016/17 with a total amount of 35.3 million tonnes. This represents an increase of output by more than 15%. In the last extracting season, Brazil was able to extract 590 million tonnes of sugarcane, which in fact was less than in the previous season. However, the sugar output rose significantly. The reason for this difference can be found in Brazil’s farmers, which concentrated the focus on their production of sugar rather than other commodities like ethanol, due to the comparatively high sugar price on the world market.

According to Reuters, Brazil’s key center-south sugar production will come in at 35 million tonnes in the extraction season 2017/18. Moreover, the analysts predict millers in this region will direct more than 47% of their sugar cane plants to sugar production in the 2017/18 harvest beginning in April. Brazil’s millers can actually choose between the production of sugar or ethanol from their sugar cane crops, while current high sugar prices encourage farmers to shift the focus on sugar.

India

In opposite to Brazil, the sugar output of India is going down in this extracting season, with an estimated total amount of 21.3 million tonnes. In the last season, the amount has been about 25.1 million tonnes. According to CCM, the average consumption in India is stated at about 25 million tonnes, which leaves some undersupply in the country and hence requires a higher import volume.

The decline in India’s sugar output can be explained by some serious drought occurrences in the main extracting areas. The most important area, Maharashtra State, is accounting for about 33% of the national production. Crop damages in this area will inevitably lead to reduced output in general.

Resulting in the severe drought occurrence, the Indian government is under pressure to remove the current 40% duty on imports of sugar. Furthermore, the affected mills also asked the government to permit the import of a million tonnes of sugar. The government has not decided on the requests and shows a more waiting attitude towards possible declining sugar prices.

China

China is capable of increasing its sugar output this extracting season by 13.79%. This leads to a total amount of 9.9 million tonnes. Looking at the yearly sugar consumption of about 15 million tonnes, the great gap between demand and supply is visible. Thus, China is far from being self-sufficient in sugar output, which makes the country still highly dependable on imports.

Thailand

Thailand, the second-largest sugar exporter worldwide, is also facing a decline in sugar output this extracting season. Similar to the situation in India, the country suffered several droughts throughout the weather phenomena El Nino, which harmed the planting situation of sugar. The output is going to decrease by 3,1% to approximately 9.3 to 9.4 million tonnes.

What’s more, Sugar is a sweet crystalline, which is usually acquired from sugar cane and sugar beet. Looking back at the season 2014/15, Asia has been the largest producer of sugar globally, due to the main sugar producing countries India, China, and Thailand. However, Brazil is known to be the largest sugar cane producer worldwide, while France and Russia used to be leading countries for sugar beets output.

*Extracting seasons of sugar 2016/17 for the four biggest producers

Brazil: April 2016-March 2017

India, China, Thailand: October 2016-September 2017

About CCM

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets.

Do you want to find out more about the sugar market in China? Try our Newsletters and Industrial Reports or join our professional online platform today and get insights in Reports, Newsletter, and Market Data at one place.

For more trade information of sweeteners, including Import and Export analysis as well as Manufacturer to Buyer Tracking, contact our experts in trade analysis to get your answers today.

Looking for a convenient way to get comprehensive and actual information as well as a platform to discuss with peers about the latest sweeteners industry and market trends? Simply subscribe to our YouTube Channel and join our group on Facebook.

People who read this article also read what the article

- Pyrethroid see price edge up, yet most insecticides have price lower in Nov. 2023/12/01

- Jan. sees most fungicide TC prices drop and weak market persist 2024/02/02

- Anhui Huilong: chlorantraniliprole TC and intermediate project to go into operation in 2024 2023/11/24