CCM: Price of ace-K stabilizes after rising for four months in China

Publish time:11/7/2016 12:00:00 AM Source: CCM

Information collection and data processing: CCM For more information, please contact us

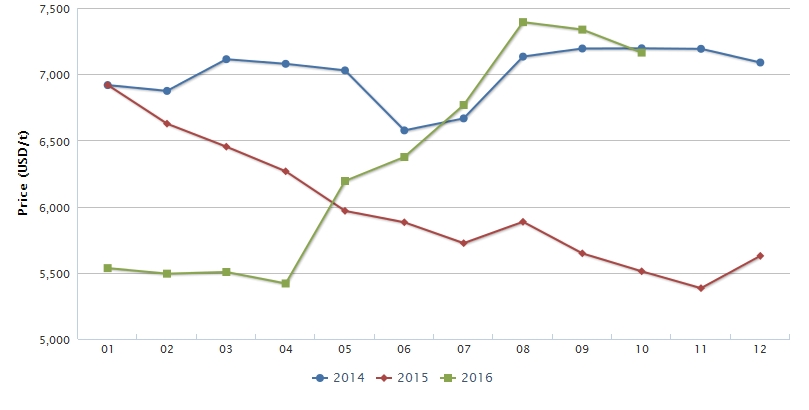

According to CCM’s price monitoring, the ex-works price of acesulfame-K (ace-K) hit USD7,163/t in Oct. 2016, up by 29.97% YoY. Regarding the price trend in Jan.-Oct. 2016, the Jan.-April 2016 prices hit historic low since 2014. However, the price kept rising since April 2016 and it rose 36.43% in Aug. compared to than in April.

Ex-works price of acesulfame-K in China, Jan. 2014-Oct. 2016

Source: CCM

Intense supply supports price rise

“The intense supply of ace-K due to production suspension from major ace-K manufacturers in China supported the price rise in April – Aug. 2016,” stated Yang Yimin, editor of Sweeteners China News, CCM.

China’s ace-K market showed large fluctuations since 2015. In Feb. 2015, key manufacturer Suzhou Hope Technology Co., Ltd. (Suzhou Hope, production capacity: 10,000 t/a) was involved in bankruptcy and reorganisation. Though it restarted production in late 2015, its shipments were small.

Suzhou Hope is not alone. In April 2016, another manufacturer of ace-K raw material, Jiangsu Tiancheng Biochemical Products Co., Ltd. (Jiansu Tiancheng), a key diketene (DK) manufacturer (production capacity: 40,000 t/a, 20% of the national figure) suspended production for environmental problem and has yet to resume production so far.

Moreover, in July, an explosion happened to another DK manufacturer Wanglong Group (production capacity: 70,000 t/a), for which to date it has yet to restart production.

According to CCM’s research, the combined DK production capacity of the said 2 companies makes up 70%+ of the national figure, which caused tight supply of DK and supported ace-K price rise.

“Oligarch” pushes up ace-K price

“In fact, seeing the suspension of ace-K related producers, the oligarch ace-K producer, Anhui Jinhe Industrial Co., Ltd. also raised the quotation in order to make more profits,” said Yang.

In April 22, Anhui Jinhe Industrial Co., Ltd. (Anhui Jinhe) raised its ace-K product by USD298.4/t to be part of the price trend.

According to CCM’s research, the current global demand for ace-K is about 15,000-18,000 tonnes, while the production capacity is at about 20,000 t/a. As the largest ace-K manufacturer in the globe, Anhui Jinhe (production capacity: 12,000 t/a) had over 7,000 tonnes delivered in Q1-3 2016, which accounted for around 40% of the total consumption.

Now major ace-K manufacturers in the world are Anhui Jinhe, Suzhou Hope, Beijing Vitasweet Co., Ltd. and Nutrinova (in Germany, production capacity: 3,000 t/a). In regards to production capacity, Anhui Jinhe is over 4 times larger than Nutrinova, showing that an “oligarch” is appearing - Anhui Jinhe of course has a say on pricing.

However, since its competitor Suzhou Hope has not yet withdrawn from the business, Anhui Jinhe, with an intention to capture more shares, will not raise price hastily. Hence, the price will maintain stability in the short run as what the price of ace-K from Aug. to Oct. showed.

Looking for more information on sweetener market in China? Want to monitor the price trend of sweeteners? CCM Online Platform is here to help you! An infinitive database, covering the whole food and feed industry in China, gives you real-time access to CCM’s over 15-year data and intelligence.

To get real-time news on sweetener market in China immediately, don’t hesitate! Get your 7-day free trial NOW!

People who read this article also read what the article

- Inner Mongolia Bihai Animal Husbandry building co-production capacity for VK3 and basic chromic sulphate 2023/05/19

- Zhucheng Dongxiao's erythritol project and Techno's sucralose project completed 2023/06/13

- Stevia projects of Huijia Biotech and Hirye Biotech in progress 2023/05/08

- Zhejiang NHU allocates funds to ensure smooth implementation of 250,000 t per year methionine project 2023/06/16

- Operating rate of glyphosate TC producer may remain low in September 2023/08/17

- Import and export of China's seeds and agricultural products in March 2023 2023/05/29

- Shandong Yonghao plans to build 1,000t per year pyroxasulfone capacity 2023/08/10

- China’s Ministry of Agriculture and Rural Affairs designates corn as a key crop for this year's economic plan 2023/05/30

- Price Trend of Haloxyfop-P-methyl in China to 2025 2023/07/14

- IDAN Survey in China 2022 2023/07/11